The Challenges Undermining UK Plastics Recycling

Plastic recycling in the United Kingdom faces persistent structural difficulties. Although household participation is high, overall recovery rates remain well below national and international targets.

Less than ten percent of plastic produced has ever been effectively recycled, while a significant share of UK waste is still exported for treatment overseas. The gap between reported progress and actual outcomes points to systemic weaknesses.

You can also read: Can the EU Hit Its 2025 Recycling Targets?

Insights from industry experts such as Stuart McCaig, Sales Manager at Ultrapolymers Limited, provide a closer view of these challenges. He highlights plant closures, price distortions, and weak enforcement as daily realities for recyclers. These findings confirm wider data and expose the structural weaknesses that prevent the UK from building a stable recycling system.

Current Position and Missed Targets

Recycling is part of everyday practice across the UK, yet progress is uneven. Surveys show nine in ten households report recycling, but half still discard recyclable materials with general waste. Items such as foil and glass bottles are often misplaced, adding contamination and reducing value.

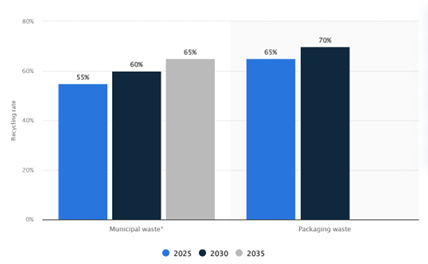

National performance reflects these gaps. The UK failed to reach the EU’s 2020 target of 50 percent recycling. England has now set a goal of 65% by 2035. However, current data indicate slow progress. Unless significant reforms are introduced, these targets are unlikely to be met.

Recycling rate targets in England from 2025 to 2035. Courtesy of Statista 2025.

Barriers to Recycling

Several barriers restrict effective recycling in the United Kingdom. Collection systems differ across local authorities, creating confusion for households and inefficiencies for processors. This lack of uniformity leads to contamination, which reduces the quality and value of recyclable material. At the same time, recyclers face strong competition from cheap virgin plastics. These products remain more affordable for manufacturers, limiting demand for recycled content. Enforcement of recycling policies also remains weak. Recyclers struggle to operate at scale and maintain long-term business stability without consistent rules and stronger oversight.

Market Imbalance and Industry Strain

Insights from industry experts highlight the deep economic imbalance facing recyclers. Cheap virgin resin imports consistently undercut UK reprocessors. Global overcapacity, especially from Asia and the United States, has sharply lowered prices for PE, PP, and PET. Recycled polymers then lose competitiveness, despite ongoing investments in quality and processing capacity. Weak checks on recycled content claims further erode trust and reduce demand certainty. Short PRN cycles add volatility and discourage long-term contracts.

Price gap that is closing recycling plants across the UK. Courtesy of Stuart McCaig.

The consequences are clearly visible. Biffa closed a polymer plant. Viridor shut facilities in Avonmouth and Rochester. Yes Recycling’s Fife site entered administration. These closures reveal systemic weaknesses rather than isolated setbacks. With margins under pressure and prices unstable, investment stalls and capacity declines. Without stronger corrective measures and firmer price signals, cheaper virgin resin will continue to displace quality recyclate.

Policy Without Effective Enforcement

The Plastic Packaging Tax requires 30 percent recycled content. HMRC sets the rate per tonne, adjusted annually for inflation. However, verification for imports remains inconsistent. Evidence from investigations shows weak checks and rising fraud risks. UK recyclers undergo strict audits and face higher compliance costs. Meanwhile, unchecked claims from abroad depress prices and weaken fair competition. Stronger enforcement is therefore urgent. Border checks should demand chain-of-custody data and verified audits. Digital evidence must track shipments and batches. Without these measures, compliant producers cannot compete and the tax signal fails to drive change.

Exports, PRNs, and the Capacity Gap

The UK still exports significant volumes of plastic waste. Reported figures exceeded half a million tonnes in 2023. These exports hide the shortage of domestic reprocessing capacity. PRNs provide short-term compliance but create volatility in the system. Reports from the NAO and Parliament have highlighted fraud and instability risks. High PRN prices sometimes push reprocessing upward. However, sudden crashes then stall investment and planning. Stronger PERN controls and reform of PRNs are now essential. Domestic reprocessing needs premiums and long-term contracts. Without these, financial pressure will continue and plants will keep closing.

Collections and Public Trust

The design of collection services directly shapes recycling outcomes. Multi-stream systems reduce contamination and deliver higher-quality material. However, flats face barriers of space, access, and convenience. Studies from London confirm weaker performance in dense housing. DEFRA’s Simpler Recycling reforms seek to harmonise systems across England. These include weekly food waste collections and kerbside plastic film by 2027. Yet collection systems alone do not secure trust. Investigations showed supermarket take-back often led to incineration. Clear labelling, public tours, and transparent reporting can restore credibility. People will sort properly when results are visible and reliable.

Technology Claims under Scrutiny

Chemical recycling attracts investment and subsidies. However, independent reviews question its performance and reliability. The Center for Climate Integrity highlights environmental and financial constraints. NRDC research describes many processes as forms of incineration. NREL studies report very low circular yields from pyrolysis. These findings show that large-scale deployment will not close the loop quickly. In contrast, mechanical recycling still delivers practical results. Upgraded equipment and design for recyclability enable immediate gains. Monomaterial films and wider PET use increase capture rates. Technology should match current material flows rather than rely on speculative mass balance claims.

Findings in Context

The United Kingdom has encouraged recycling for decades. However, current evidence shows that plastics recycling is struggling at every level. Households are confused, recyclers are shutting plants, and policy is failing to create a fair market.

The lesson is clear. Recycling cannot work without strong enforcement, investment in domestic infrastructure, and consistent demand for recycled materials. Cheap virgin plastics will continue to dominate unless governments intervene and brands commit to using recyclate. Without decisive steps, the UK will remain locked in a cycle of low recycling rates and rising plastic waste.