Aerospace Plastics Market: Lighter, Stronger, and Poised for Takeoff

Lightweight, durable, and increasingly indispensable, plastics are reshaping the aerospace industry and driving a market projected to nearly double by 2030.

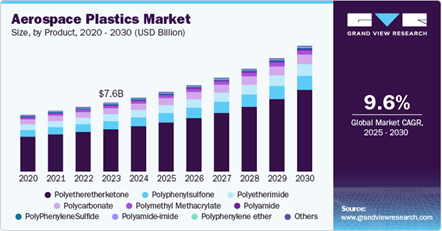

The aerospace plastics market is entering a new stage of accelerated growth. According to Grand View Research, analysts valued the sector at USD 8.15 billion in 2024 and project it to climb to USD 8.79 billion in 2025, reaching USD 13.88 billion by 2030. That represents a compound annual growth rate of nearly 10% over the forecast period.

You can also read: Inside the Technology of Aircraft Windows.

Global Aerospace Plastics Market Projected to Grow at 9.6% CAGR (2025–2030). Courtesy of Grand View Research.

This surge reflects a fundamental shift in how engineers design and manufacture aircraft. Airlines, defense contractors, and space agencies are all looking for ways to reduce weight, cut fuel consumption, and extend operational range without compromising safety. Plastics, particularly high-performance polymers, are increasingly the materials of choice to achieve these goals.

Why Plastics Matter More Than Ever

In aviation, weight reduction is more than a design preference; it is a performance imperative. Every kilogram removed from an aircraft has a direct impact on fuel efficiency. The International Air Transport Association estimates that a 1% weight reduction can save hundreds of thousands of liters of fuel per aircraft each year.

Plastics are helping manufacturers meet these targets thanks to their exceptional strength-to-weight ratio. Materials such as polyether ether ketone (PEEK), polyimides, and polyetherimides not only match but in some cases exceed the performance of metals in specific applications. They offer resistance to extreme temperatures, chemical stability, and compliance with stringent fire, smoke, and toxicity standards.

Their manufacturing flexibility is equally important. Engineers can mold plastics into complex shapes that would be expensive or impossible to achieve with metals. This ability reduces assembly steps, eliminates fasteners, and often improves aerodynamics.

The Dominance of PEEK

Among aerospace polymers, PEEK holds a commanding position. In 2024, it accounted for more than 61% of market revenue. Its flame retardancy, low smoke emission, and exceptional fatigue resistance make it ideal for demanding structural and mechanical components.

From engine parts and electrical insulation to cabin fixtures and seating components, PEEK delivers consistent performance under harsh conditions. While it is more expensive than many other polymers, the long-term savings in fuel, maintenance, and service life often outweigh the initial investment.

Research is also pushing the boundaries of what PEEK can do. New composite grades are combining the polymer with carbon fibers or ceramic reinforcements to further enhance stiffness and heat resistance.

Applications Shaping the Market

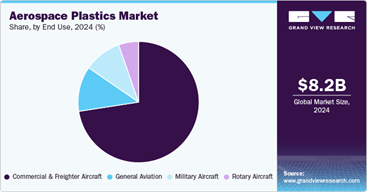

The global aerospace plastics market reached a valuation of $8.2 billion in 2024, with the Commercial & Freighter Aircraft segment holding the largest share. A key driver of this market is the extensive use of plastics in cabin interiors, which accounted for an estimated 29% of market revenue. These lightweight, durable polymers are critical for components such as seats, galleys, and wall panels, helping aircraft meet strict safety regulations while reducing overall weight.

Furthermore, the application of plastics is expanding into structural components like fairings and winglets, as well as high-performance parts within propulsion systems, where engineers value them for their temperature resistance and mechanical strength. As the aerospace industry continues to innovate, analysts expect demand for advanced polymers to grow, cementing their role in enhancing aircraft efficiency and safety.

Aerospace Plastics Market by End Use: Commercial Aircraft Lead in 2024. Courtesy of Grand View Research.

Regional Trends and Opportunities

North America remains the largest regional market for aerospace plastics, generating USD 4.3 billion in revenue in 2023. Analysts expect that figure to rise to USD 7.7 billion by 2030, driven by strong demand from both commercial aviation and defense programs.

The United States’ concentration of aerospace manufacturers and polymer innovators accelerates material adoption. Mexico is emerging as an important production hub, with investments in plastics processing capabilities to support global supply chains.

Europe continues to focus on sustainable solutions, with manufacturers exploring recyclable polymers and bio-based composites. Meanwhile, Asia-Pacific is expanding rapidly as China and India grow their aircraft fleets and enhance domestic manufacturing capabilities.

Drivers Behind the Growth

Several factors drive the momentum behind aerospace plastics. Fuel efficiency remains the most compelling, as fuel can account for 20–30% of airline operating costs, and reducing aircraft weight directly improves profitability.

At the same time, stricter emission reduction targets push manufacturers toward lighter, more efficient materials. Plastics facilitate aerodynamic designs that help meet these environmental goals. Durability adds another benefit: unlike metals, many aerospace polymers resist corrosion, reducing long-term maintenance and extending the lifespan of critical components.

Challenges in the Market

Despite strong growth, the aerospace plastics sector faces hurdles. High-performance polymers are costly, requiring clear lifecycle savings to justify investment. Certification adds delays, as new materials must undergo extensive testing to meet aviation authority requirements.

Supply chain vulnerabilities also pose risks, with limited production sources sensitive to geopolitical shifts. Finally, end-of-life recycling remains underdeveloped, as manufacturers can recycle only some polymers mechanically or chemically, and scalable systems are lacking.

Competitive Landscape

Leading players in the aerospace plastics market include SABIC, Victrex, Solvay, BASF, Evonik, Drake Plastics, and DuPont. These companies are not only supplying materials but also offering design assistance, testing support, and regulatory expertise.

Partnerships between polymer producers and aerospace OEMs are critical for accelerating the introduction of new materials. Joint development programs often target improved heat resistance, flammability performance, and manufacturability.

Future Outlook

By 2030, analysts expect the global aerospace plastics market to approach USD 14 billion in value. Cabin interiors will likely remain the largest segment, but structural and propulsion applications will continue to gain share.

Emerging aerospace clusters in Mexico, Southeast Asia, and Eastern Europe will reshape manufacturing networks and create new opportunities for polymer processors. Advances in additive manufacturing could also enable certified on-demand production of plastic components, reducing lead times and inventory needs.

The next decade will reward companies that can combine material innovation, regulatory agility, and supply chain resilience. Those that succeed will capture market share and help define the future performance and sustainability standards of aerospace manufacturing.