Toward Net-Zero Plastics: Aligning the Value Chain

Plastics emit 3% of global CO₂. Aligning the value chain—via recycling, clean tech, and circularity—can cut emissions up to 90% by 2050.

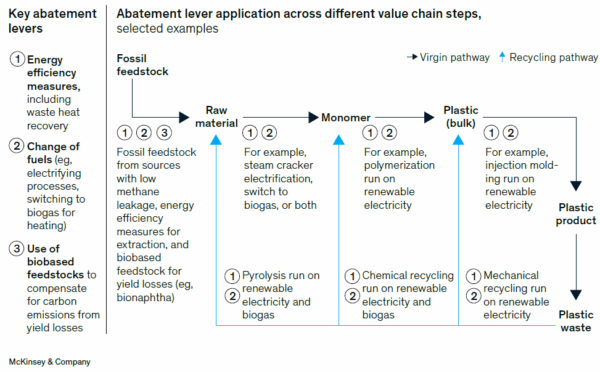

As the plastics industry faces growing pressure to meet decarbonization goals, aligning the whole value chain—from feedstock production to end-of-life recovery—has become an urgent priority. A recent report by McKinsey & Company outlines a clear message: although low-carbon technologies exist, scaling them will require unprecedented coordination across sectors and geographies.

You can also read: Carbon Capture in Plastics Manufacturing.

Plastics’ Emissions Footprint—and Its Reduction Potential

The report estimates that plastics contribute roughly 3% of global CO₂ emissions, translating to around 1.2 billion metric tons of fossil-based CO₂ released annually. Encouragingly, the study suggests that a 90% reduction in emissions is achievable by 2050 if the industry successfully transitions to circular and renewable systems. Yet this won’t happen passively.Industry leaders must realign the value chain to prioritize material performance, improve process efficiency, innovate feedstocks, and strengthen recycling infrastructure.

Where Emissions Occur in the Plastics Lifecycle

Emissions in the plastics value chain arise at multiple stages:

Feedstock extraction and processing contribute roughly 20%.

Monomer production, especially steam cracking, accounts for 25–50%.

Polymerization and modifying processes represent 30–55% of emissions.

These numbers vary significantly depending on polymer type, regional energy mixes, and production technologies. That variability reinforces the need for targeted decarbonization strategies for each material stream.

Shorter Loops, Bigger Impact: The Role of Recycling

Recycling—both mechanical and chemical—can sharply reduce emissions by bypassing fossil feedstocks and avoiding energy-intensive production steps. However, the benefits hinge on three key variables:

The type of recycling technology used,

The quality and type of plastics being recycled,

The carbon intensity of the energy source powering the process.

McKinsey highlights that short-loop recycling systems, where plastics are reused quickly with minimal processing, deliver the highest carbon savings. But scaling these loops requires overcoming hurdles in material contamination and sorting.

Decarbonization Levers in Reach

Several practical measures are already available to the industry:

| Category | Strategy or Technology | Impact on Emissions | Challenges | Stage of Adoption |

|---|---|---|---|---|

| Production Efficiency | Energy optimization & heat recovery | Moderate | Requires system upgrades | Widely available |

| Energy Transition | Fuel switching (e.g., renewables) | High | Infrastructure and cost | Growing |

| Feedstock Shift | Biobased inputs (e.g., bionaphtha) | High | Feedstock availability and competition | Emerging |

| Process Electrification | Electrified steam cracking | Very high | High capex, early-stage technology | Pilot phase |

| Recycling | Mechanical recycling | Moderate to high | Contamination, material quality | Established |

| Recycling | Chemical recycling | High | Energy intensive, cost | Early commercialization |

| Circular Design | Short-loop recycling systems | Very high (if optimized) | Design-for-recycling, logistics | In development |

| Feedstock Access | Postconsumer waste recovery | High (if scaled) | Sorting infrastructure, quality limitations | Underutilized |

| Market Coordination | Aggregating demand for low-carbon materials | Indirect but enabling | Requires cross-sector alignment | Needs scale-up |

These levers can be applied to both virgin and recycled plastic production pathways and should be prioritized by industry leaders now, not later.

Unlocking Feedstock from Postconsumer Waste

A critical barrier remains: postconsumer plastic recovery is still far too limited. Key opportunities lie in recovering materials from:

Consumer goods packaging

Automotive plastics

Construction materials, despite contamination challenges

Focusing on these sectors could unlock millions of tons of untapped secondary feedstock, enabling a more circular plastics economy.

What Comes Next?

To realize these gains, McKinsey advises plastics stakeholders to:

Prioritize energy efficiency over capacity expansion.

Launch pilot projects using breakthrough technologies.

Aggregate cross-sector demand to spur investment in low-carbon alternatives.

Improve short-loop circularity through better collection, design, and material standards.

A Call for Industry-Wide Alignment

The race toward net-zero plastics isn’t just about innovation, t’s about collaboration. McKinsey’s report underscores that value chain players who move early to secure renewable feedstocks, circular materials, and clean technologies will not only cut emissions—they’ll also build long-term resilience and brand value. As decarbonization accelerates across industries, the plastics sector must step forward not only with ideas, but with action.

Based on insights from McKinsey & Company’s report “Aligning the Value Chain to Decarbonize Plastics”.