New Jabil survey highlights key 3D printing trends

Growth in AM continues, despite concerns over material costs and availability

The latest Jabil Inc. global survey about 3D printing reveals provides insights into key usage trends, expectations and challenges related to this burgeoning technology. Findings included continued growth in the use of 3D printing to make production parts, concerns about the cost and availability of materials, and expectations of moderate growth in the application of the technology, also known as additive manufacturing (AM).

Jabil, a St. Petersburg, Fla.-based contract manufacturer that registered $33.5 billion in sales last year, has conducted this survey every other year since 2017. This year’s study –– sponsored by Jabil but conducted by SIS International Research –– gathered responses from 200 mid- to senior-level decision-makers who oversee additive manufacturing within their organizations. Jabil acknowledges that this year’s respondents tilted heavily toward large corporations, with 65 percent of those participating saying they work for companies with more than $5 billion in annual revenue. This demographic mix may serve to skew some of the comparisons to earlier Jabil studies.

Prototyping and design see benefits

Still, there are interesting results to be culled from the 36-page report. Prototyping remains the predominant use of additive manufacturing for the majority of those surveyed, but since 2017, there has been continued growth in the use of 3D printing for production parts (67 percent of 2023 respondents), bridge production (59 percent), and jigs, fixtures, and tooling (58 percent). Prototyping also is widely recognized as the area most significantly benefited by AM (selected by 96 percent of respondents), followed by design (52 percent) and small-scale production (27 percent).

Still, there are interesting results to be culled from the 36-page report. Prototyping remains the predominant use of additive manufacturing for the majority of those surveyed, but since 2017, there has been continued growth in the use of 3D printing for production parts (67 percent of 2023 respondents), bridge production (59 percent), and jigs, fixtures, and tooling (58 percent). Prototyping also is widely recognized as the area most significantly benefited by AM (selected by 96 percent of respondents), followed by design (52 percent) and small-scale production (27 percent).

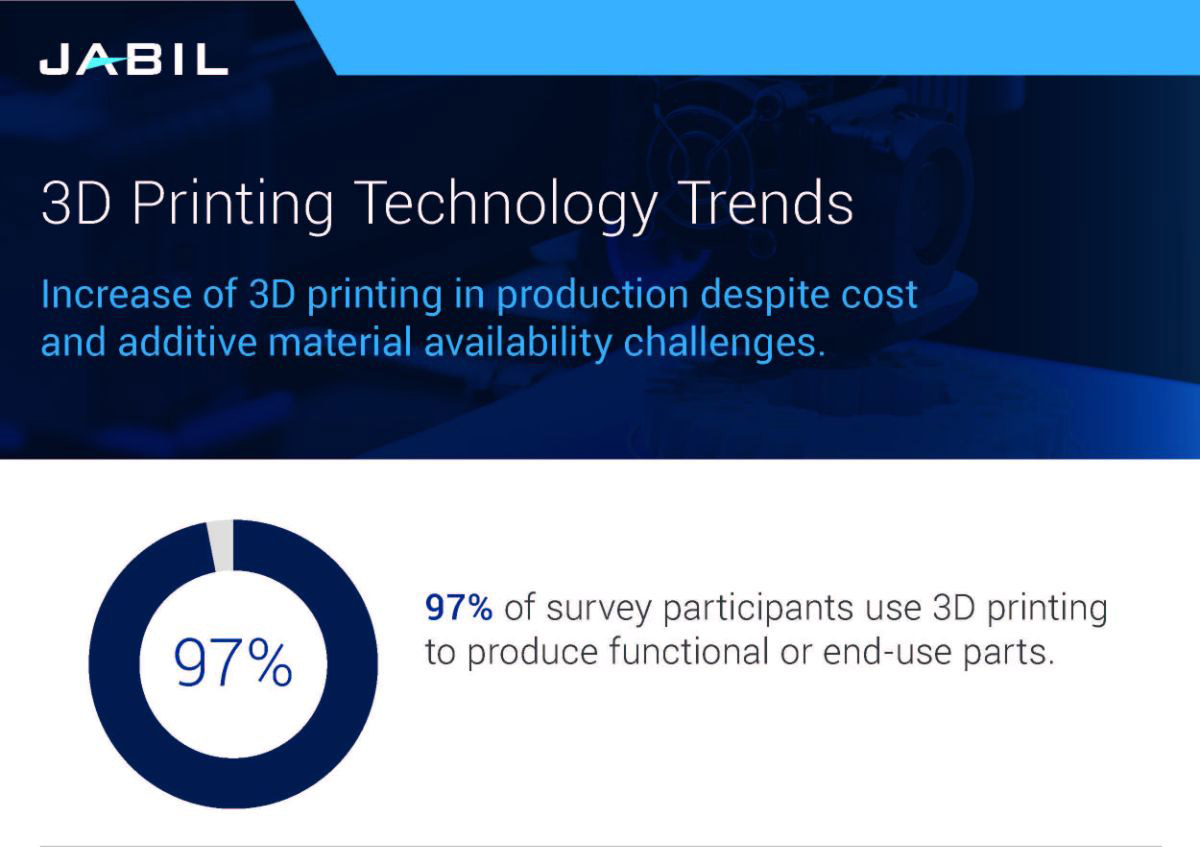

Still, the study notes, “an impressive 97 percent of survey participants said their companies employ additive manufacturing to create functional or end-use parts.”

Plastics and polymers remain the leading materials used in additive manufacturing among 97 percent of those polled, but the use of metals has increased sharply. Two-thirds of respondents’ companies use custom-engineered materials in their additive manufacturing processes.

Material availability remains a key concern

The study found a substantial rise in material-related issues in the AM process, with 85 percent of decision-makers stating that such problems hinder their companies from increasing 3D printing production. This, Jabil suggests, can be ascribed to the growing demand for 3D printing materials, which is not being met by a corresponding increase in supply.

Nine in 10 participants said the biggest AM materials challenge they face is that the materials they need are not available. This represents a 57 percent increase since 2021, demonstrating the extent to which shortages are affecting the 3D printing process. On a more positive note, there has been a significant improvement in product reliability and trust in additive-manufactured products. Currently, only 12 percent of respondents expressed concerns about the parts produced, marking a 15 percent decrease from 2021.

Cost presents an obstacle to growth

Even when materials are available, their cost presents a significant financial obstacle for many companies wanting to expand their 3D printing capabilities. This issue is the foremost concern, identified by 79 percent of survey participants –– marking a substantial increase since the 2021 survey. Additionally, concerns related to machinery or capital expenditures have doubled.

“On a brighter note,” the survey notes, “companies have experienced notable advancements in innovation. For example, technology limitation challenges have decreased by 16 percent since 2021, and part quality issues were reported by only 12 percent of respondents, compared to 37 percent in 2021. These developments suggest enhancements in technology and the dependability of 3D-printed components.”

Signs of tempering expectations

The 2023 survey revealed a noticeable change in expectations, as the majority of respondents (62 percent) said they foresee “a moderate increase” in the use of AM in their organizations. This contrasts with previous results, which typically predicted substantial and rapid growth. The shift in expectations, Jabil suggested, could be attributed to the widespread adoption and proficiency in 3D printing, leading decision-makers to become more aware of the technology’s potential.